The Government

The

Federal Council is Switzerland’s government. It consists of seven members, who take decisions and defend their decisions in a

collegial manner. The presidency rotates every year. The Federal Council is assisted

in its tasks by the Federal Administration. The Confederation’s expenditure may

not exceed its receipts over the longer term: this is ensured by the debt brake

mechanism. The budget is decided by Parliament.

Federal finances: Parliament has the final say

In order

to fulfil its tasks, the Confederation needs money. The Federal Constitution

sets out what taxes the government can raise. When it comes to spending money,

the Federal Council cannot just do as it sees fit: there is a legal basis for

every item of expenditure that is the result of a democratic process.

Parliament

has sovereignty over federal finances: it decides the budget and approves the

state financial statement of the previous year.

Debt

brake mechanism

The Confederation is required

to balance its expenditure and receipts over the longer term. It is required to

run a surplus when the economy is thriving and may spend more than it collects

in receipts when the economy is weak. The debt

brake does allow for an exception to be made in extraordinary situations such as serious economic crises and

natural disasters; the government may then undertake additional expenditure.

Extraordinary expenditure

The

COVID-19 pandemic has resulted in one of the most serious economic downturns in

recent decades. To help the economy and the public, the

Federal Council and Parliament passed support measures to the tune of tens of

billions of francs. At the same time the Confederation faces a shortfall in

receipts. Thanks to its low public debt, Switzerland and the Confederation in particular are

in a sound financial situation.

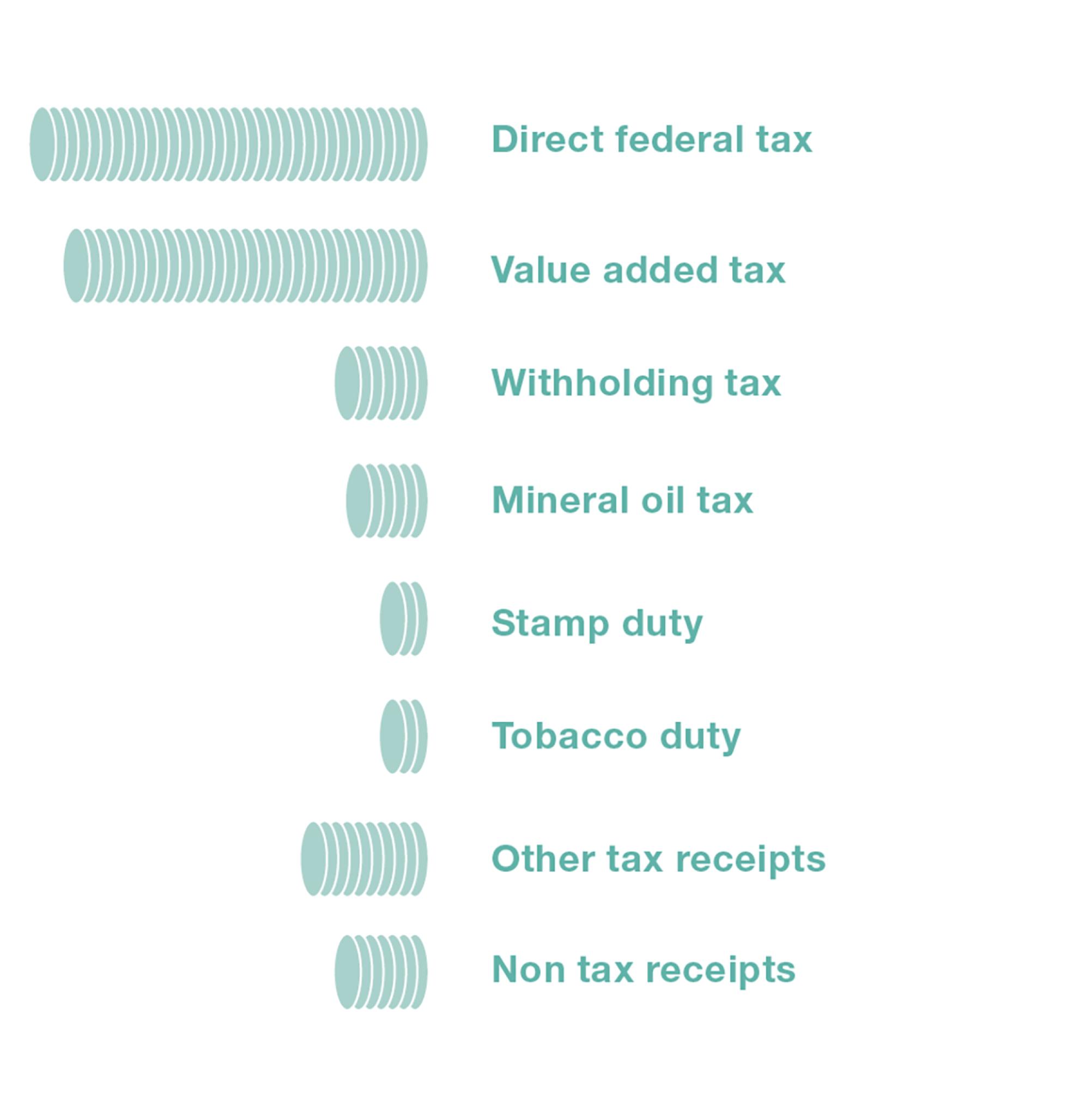

Federal receipts and expenditure 2020

Receipts of 72

billion

The federal government's main

sources of receipts are direct federal tax and VAT. Direct federal tax is

raised on the income of private individuals (progressive, max. 11.5%), and on

business profits (8.5%). VAT is 7.7% on most goods and services.

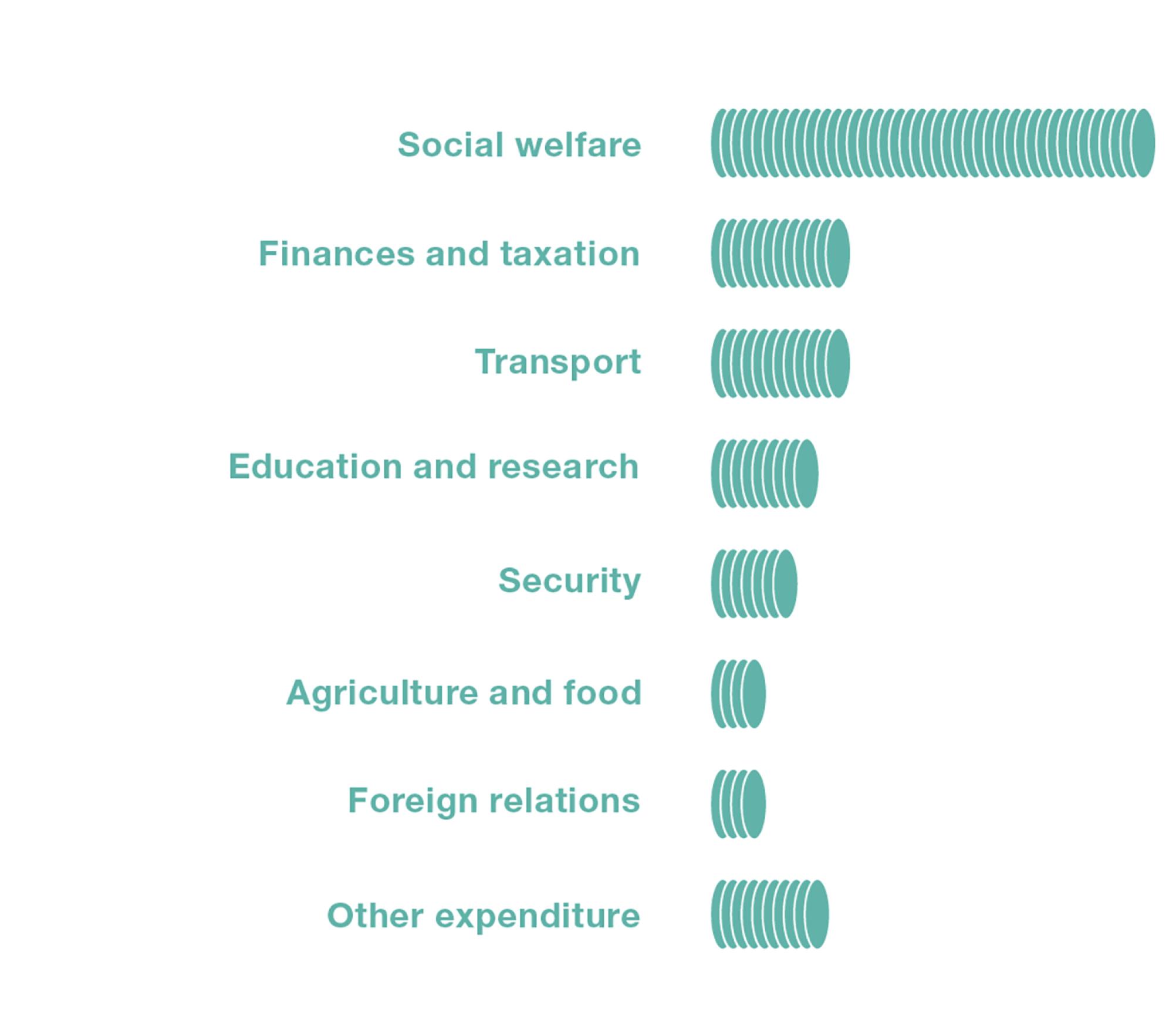

Expenditure of 87.8 billion

The Confederation dedicates 41% of federal expenditure to social

welfare. Half of that goes towards old age pension provision (OASI), and a

sixth to invalidity insurance (II). In 2020 this also included

funds to tackle the consequences of the COVID-19 pandemic. i.e. short-time

working compensation (10.8bn) and Corona loss of earnings compensation (2.2bn).

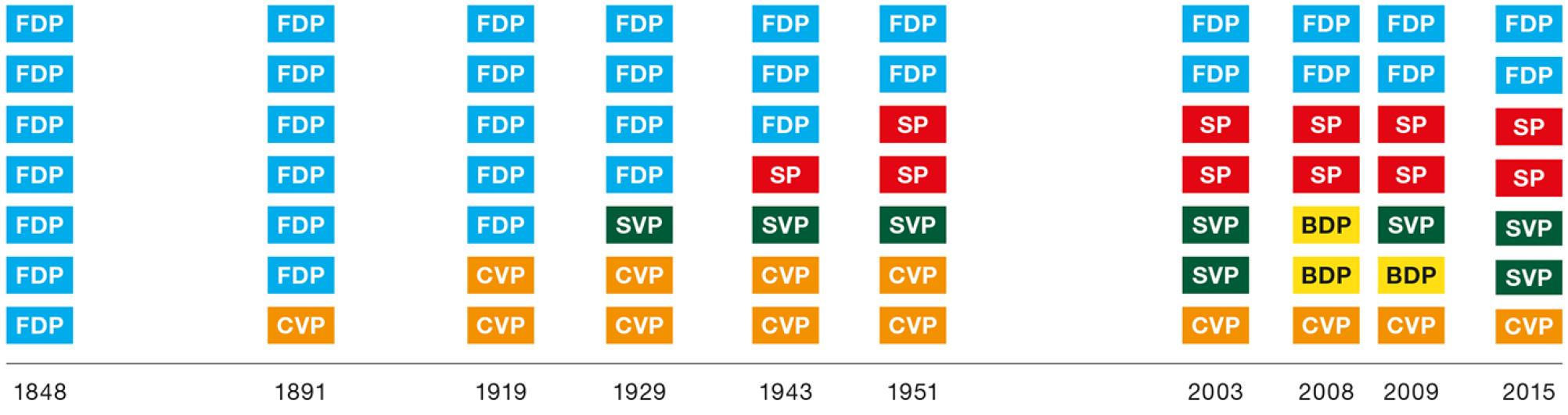

Political party composition of the Federal Council since 1948

1848

The Federal

Council was composed of seven members of the Free Democratic Party (today FDP.The

Liberals). The party governed alone for 43 years.

1891

The first member of the

Catholic Conservatives (today CVP) joined the government; the second joined in 1919.

1929

Parliament elected a member of the Farmers’, Trades’

and Citizens’ Party (today SVP) to the Federal Council.

1943

The first Social

Democrat (SP) entered the government; the second followed in 1951.

1959

The four strongest parties agreed to form a

government by applying the ‘magic formula’:

2 FDP, 2 CVP, 2 SP,

1 SVP. The formula remained unchanged for 44 years.

2003

At the Federal

Council elections, the SVP won a seat at the expense of the CVP.

2008

The two

representatives of the SVP joined the newly founded Conservative Democratic

Party (BDP).

2009

A member of the SVP was elected in place of a

retiring BDP representative.

2015

The BDP

representative stepped down. Parliament elected an SVP representative in her

place.

Since then

The Federal Council has again been composed of members from four different

political parties – according to the 2:2:2:1 formula.